The U.S. is shaping its future in the international textile market.

by Seshadri Ramkumar

In the past two decades, most advanced nations have focused on advanced technology, paying specific attention to sectors such as information technology and biotechnology. While these fields are vital to the economy, COVID-19 has exposed vulnerabilities in the manufacture of products that are vital in our day-to-day lives and can, in fact, be lifesaving.

More recently, it has become evident that there is a global shortage, for example, of semiconductors; developed nations have been dependent on East Asian countries, such as South Korea and Taiwan, for the manufacture of these critical products. Earlier in the pandemic, the U.S. was depending on China for the supply of three-ply surgical masks and N95 masks were also in tight supply. The pandemic has drastically changed the economics dynamic, and developed nations must refocus on certain segments of manufacturing to not only have a good handle on the supply chain, but to also provide employment opportunities.

Global manufacturing is expected to decline in the next few years, which will have ripple effects causing job losses, less capital and fewer R & D investments. This scenario provides opportunity to regroup and focus on priorities and strategic manufacturing in areas of necessity. There is a timely need to strengthen American manufacturing, particularly in areas related to health, protection of the environment, industrial segments and automotive products. According to the National Association of Manufacturers (NAM), onshoring and boosting manufacturing are critical, and it has highlighted strategies in its American Renewal Action Plan.

U.S. and manufacturing

Manufacturing in the U.S. is at a crossroads, as there is a need to deliver consumer and industrial goods at a competitive price, while protecting American jobs. The cost competitiveness offered by some countries with an edge in manufacturing (China, Bangladesh and Vietnam, for example) has systematically forced manufacturing out of the U.S. and Europe. However, the importance of manufacturing in providing necessities, as well as jobs, is abundantly evident. Additionally, its impact on offering a nation self-reliance has been profoundly felt in the course of the pandemic.

The recent trade conflicts between the U.S. and China involved a variety of important issues. Protection of intellectual properties, currency manipulation and disparities in the cost of manufactured goods—particularly commodity items—have been among the most contentious.

While it may not be feasible to compete with low-wage countries in commodity items, developed nations must focus on manufacturing of advanced products which find applications in health, infrastructure and the environment. Supportive policies are needed to grow advanced manufacturing, sustainable manufacturing, the green economy and a circular economy.

The Indian Government’s “Atma Nirbhar,” a plan for Indian self-reliance, endeavors to grow its manufacturing with the aim of creating jobs and expanding its economy. U.S. President Biden’s administration is also emphasizing the “Made in America” concept to support U.S. manufacturing and allied sectors.

On January 25th, President Biden issued an executive order that the U.S. Government should procure services and products from domestic businesses as a way of creating jobs, as well as a means to spur growth. This order also calls for the Federal Acquisition Council to seek input into the possibility of increasing domestic content requirements in the final products and their construction materials.

Additionally, to protect U.S. manufacturing, the order calls for examining the feasibility of pricing considerations for domestic products through proper procedures by seeking public comments and using applicable laws. The manufacturing sector could see a growth based on dual, albeit a parallel, approach by broadening the product “basket” with varied applications and enhancing the efficiency of the sector.

The National Association of Manufacturers has proposed a framework for manufacturing growth. Among the recommendations, NAM advocates a new tax credit that focuses on investment costs—16 percent of the cost associated with onshoring investments involving equipment, payroll costs and R & D costs.

A greater emphasis is on skill training and retooling the workforce. A public-private partnership (PPP) fund of $1 billion to support research and development has been advocated—a timely and critical need. The PPP fund will provide necessary oversight by practitioners in the industry to fund those projects that are critically needed and are mission linked. This in no way will diminish the need and support for basic research funded by other federal agencies.

Promising market segments

Emphasis on manufacturing does not mean focusing the manufacture of commodity products, where some Asian countries have competitive advantages. In the manufacturing sector, developed economies have competitive advantages in some subfields, such as raw materials, developing finished products, functional chemistries and finishes, for example.

Advanced textile products that cater to health, infrastructure, defense and automotive sectors have a promising future. Manufacturing these value-added products, investing in research and development, supporting industry and academia linkages must be pursued.

The U.S. is among the top three globally in the production of cotton. In terms of quality, cotton from the U.S. and Australia occupy a preeminent position. High-performance fibers such as ballistic resistant fibers and sustainable fibers, such as PLA (polylactic acid, a plant-derived thermoplastic) came out of research and development in developed economies. There is a need for applied and mission-linked research in the development of next generation fibers and functional finishes and high production machineries.

While European countries like Germany, Italy and Switzerland have strength in the manufacture of textile, nonwovens and converting machineries, China is slowly closing in the gap with the manufacturing of converting machines. It is important that U.S. and European nations maintain their strategic strengths in raw materials and machinery, which will enable job growth. While alternatives to synthetic materials are emerging, it is important to also look at their economic viability. This will be part of the green economy agenda, which will also create jobs in the R & D and manufacturing sectors.

The recent winter storms in Texas have highlighted the importance of energy diversification and the need for insulation materials and winter preparedness. Soft and hard composite materials and nonwoven roll goods find applications in these areas, such as glass fiber materials, composites for developing automotive parts and energy accessories.

High margin products such as battery separators and graphene-based products offer new opportunities, albeit market size may be small. With the emergence of different virus variants, high efficiency filters are needed. While nano-based substrates have been used in high efficiency filters and personnel protective equipment, areas related to meltblown nonwovens, metal and metal-oxide coated substrates will get attention from research organizations, academia and industry.

Investments in infrastructure receive wide support and this provides plenty of opportunities for the industrial fabrics industry. It is necessary that industrial associations, such as the Industrial Fabrics Association International (IFAI), the Association of the Nonwoven Fabrics Industry (INDA) and the National Council of Textile Organizations (NCTO) to engage with regulatory bodies and policy makers to make some recommendations on the mandatory use of advanced textile products. It is interesting to note that Indian technical textile manufacturers through their representative body, the Indian Technical Textiles Association, have been demanding the mandatory use of geotextiles in highway constructions.

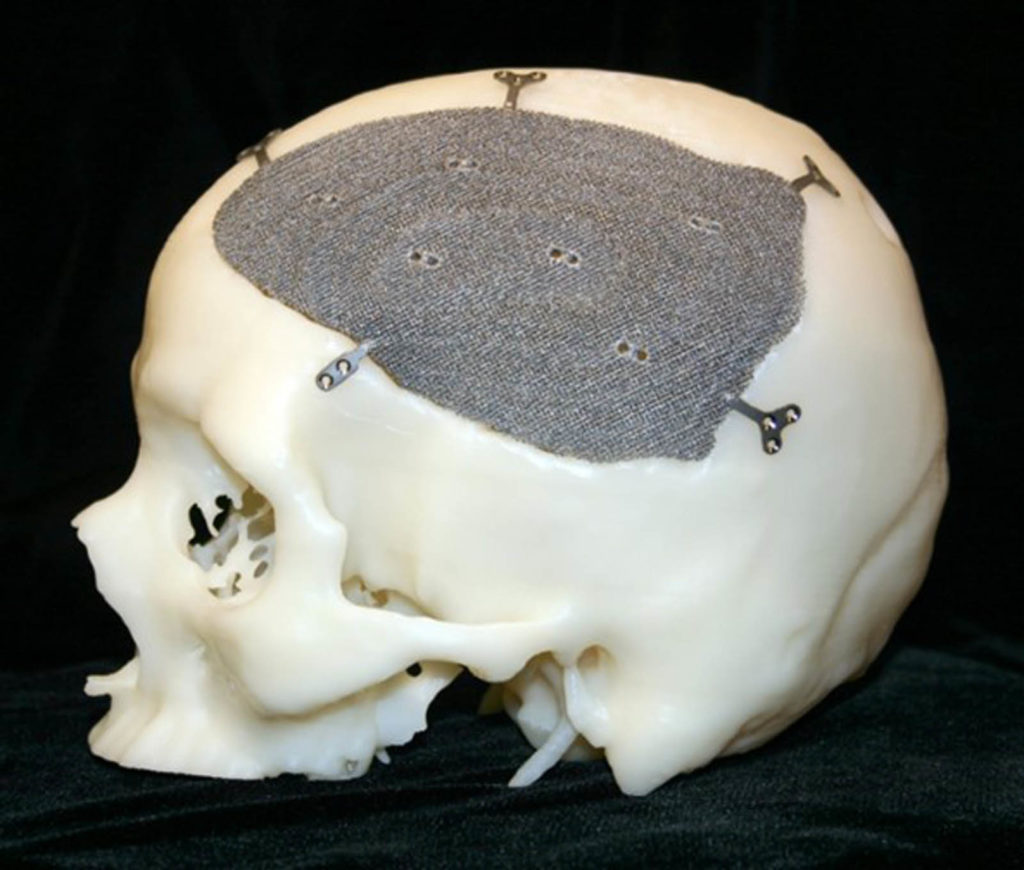

Custom manufacturing and 3D printing of consumer goods, medical devices and human body parts is a fertile area. Polymeric materials find applications in these advanced manufacturing sectors. “3D printing of patient specific implants ushered in a process of design optimization for individual needs,” says Dr. Dr. Jayanthi Parthasarathy, manager 3D Printing, Nationwide Children’s Hospital. Columbus, Ohio. “3D printing lends itself very well to the production of parts to make implants with engineered material properties to match the region of implantation.”

Because of COVID-19, there is a renewed interest among the industry, academia and policy makers to revive manufacturing in the developed economies. It should be noted that all fields within the manufacturing sector may not be viable, however there are areas where onshoring is a must—health, environment and defense, in particular.

Tax credit and incentive schemes, as well as skill-enhancement programs will attract broader support and must be utilized to bring back manufacturing. Industry associations should develop guiding frameworks and identify areas that are feasible and viable technologically and economically. The manufacturing sector of the next decade will also have to be sustainable, both from technical and economic points of view.

Seshadri Ramkumar, Ph.D., is a professor in the Nonwovens and Advanced Materials Laboratory, Texas Tech University, and a frequent contributor to Advanced Textiles Source.

TEXTILES.ORG

TEXTILES.ORG