Partnerships all along the supply chain lend critical support in achieving goals.

by Marie O’Mahony

Rita McGrath, associate professor at Columbia Business School, advises that “change is not the dangerous thing, stability is.” In this second of two articles on innovation, the focus is on factors that can influence the way that innovative textiles come to market. The two key areas examined are the value network and the supply chain. Recognizing and addressing the need to change in either of these can be difficult, but it is necessary.

The first step, realizing that something has to be done differently, may not be obvious. Here we look at examples from research, manufacturing and retail to take note of other ways the need for change is being recognized, and new partnerships and practices are put into place.

The value network

In The Innovator’s Dilemma (1997), Clayton M. Christensen issues a stark warning that “today’s competitive advantage may become tomorrow’s albatross unless strategists attune themselves to changes in underlying conditions.” Vital to achieving this is the value network, which Christensen describes as the context within which a company identifies and responds to their customers needs, addresses problem solving, procures input, responds to competition and pursues profit.

At the Association of the Nonwoven Fabrics Industry (INDA) RISE 2018 conference, the European directive on single-use plastics, issued just months before this event, became one of the most hotly discussed topics, with many in the nonwovens industry participants already prepared with strategies to address it.

Proctor & Gamble sees addressing environmental impact as both a challenge and an opportunity. In their P&G Citizenship Report 2018 the company looked at sustainable innovation along with their supply chain working toward “driving innovation that is sustainable for both the business and the planet.” Consumer engagement is critical, so that in January 2019 Proctor & Gamble announced a partnership with Loop, a company that is the first of its kind offering a global packaging and shopping, circular-solution, e-commerce platform developed by the international recycling leader TerraCycle. The agreement includes a “collect and recycle” circular solution with the introduction of reusable, refillable packaging on some of the company’s most popular products.

In Deloitte’s Global Powers of Retailing 2018, IKEA is ranked 27th, just below Best Buy, so that in June of this year, when IKEA announced a plan to replace all virgin polyester textile products with recycled polyester by 2020, the impact on the synthetic textile industry has been considerable. “From our own history we know that when we overcome challenges it becomes opportunities,” says Nils Månsson, material and innovation deployment leader for IKEA. “By recycling PET products, we’re giving them a second life. We also hope to inspire others to follow for a greater positive impact on people and planet.”

The retail giant is one of the biggest customers for Outlast, the phase-change material (PCM) company. They have already begun to include recycled materials in their PCM portfolio, using 100 percent recycled polyester to meet the Global Recycle Standard (GRS). Addressing consumer behaviour patterns can also be an important part of the innovative process. As Dirk Keunen, director of sales at Outlast Technologies GmbH, explains, the consumer still expects whites to be “bright.”

For IKEA, the use of PCMs falls within its grouping of reactive smart textiles according to Linda Worbin, material and innovation developer with the retailer. She describes three groups of smart textiles: passive, reactive and connected. Worbin undertakes R&D for the IKEA product design teams, looking to solve their needs over the next five years. “It’s about finding meaningfulness,” she says, matching functionality to need, moving steadily from a “static” home to a digitally connected one.

Taking account of environmental goals and the breadth of international reach, meeting global and local standards, addressing cultures, and considering current and future consumer expectations all make the challenge of introducing innovation a complex one. The three-staged view of smart materials allows the time and space for trial and error as the nascent market develops.

“You can’t focus on technology only,” according to Mark Croes, consultant in hygiene and medical at Centexbel. “It has to be the whole supply chain.” Centexbel is a membership organization with a mission is to promote research and technological development with the intention of enhancing the cost-effectiveness, quality and production capacity of the Belgian textile industry. On behalf of its members, it undertakes R&D, product certification, product analysis, material characterization and testing, as well as knowledge dissemination. As the European Patent Office (EPO) shows Belgian patent applications increased by 9.7 percent in 2018, speed to commercialization is needed to convert this to product and to profit.

“Because Centexbel is industry-driven, the shorter the better, and five years is a long time,” says Croes. “Manufacturers in Belgium are looking to strengthen the whole supply chain.”

To address this need, the organization has broadened its scope, establishing Centexbel-VKC, a “one-stop-shop” for the plastics value chain, offering integrated facilities for materials research, development, testing, recycling and training. The MAKE LAB offers a semi-industrial pilot production line to accelerate the process of bringing together materials and processes from textiles to plastics and 3D printing.

These hybrid materials, each with their own provenance, come with a particular challenge in scaled manufacturing for production, as well as recycling and end-of-life. Addressing these issues early on can only be of benefit when it comes to establishing the supply chain for commercialization.

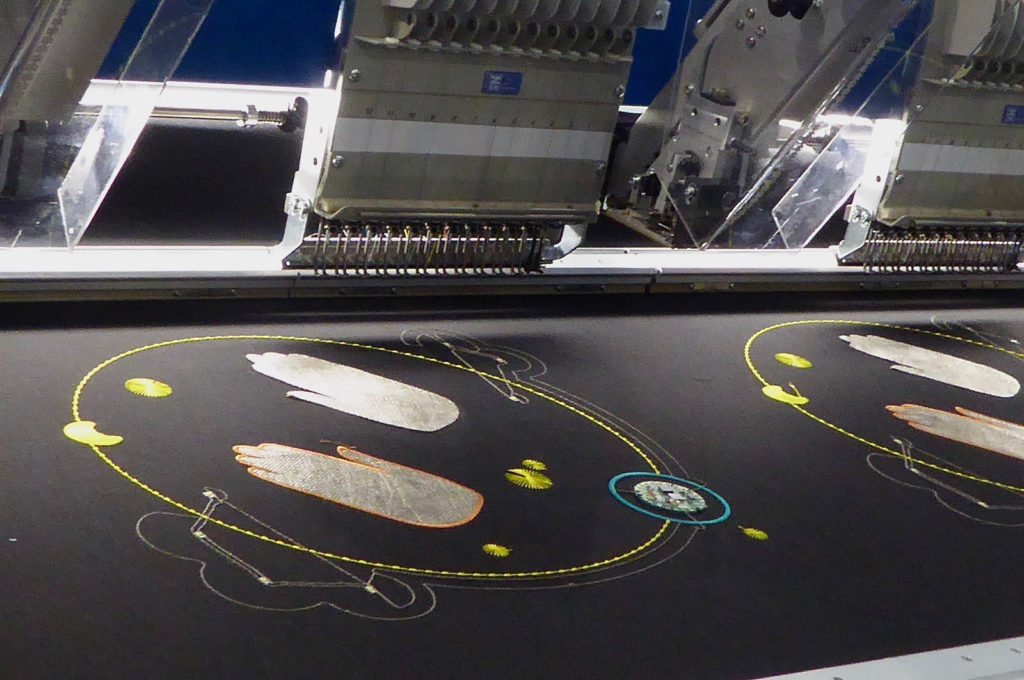

“Ninety percent of all our projects are related to industry,” says Dr Volker Lutz, head of additive and joining technologies and the Smart Textronics Centre at ITA, RWTH University in Germany. Industry is also the source of much of their funding, and that brings an added impetus to their research direction. The research starts with fiber production and goes through to the finished product.

There is a significant focus on smart textiles, because, as Lutz sees it, this is an area that is still seeking solutions. Germany is the EPO top patent-filing country in Europe, increasing significantly by 4.7 percent in 2018. This is attributed to an upward trend in the automotive and related sectors, such as for sensors and other measuring devices.

Looking to the future, Dr. Lutz sees that there is still a lot to be accomplished starting at the design stage and helping designers understand what is possible from a technological point of view. He also sees technology integration as important, creating a better alignment as materials and processes are brought together in preparation for manufacturing. Without integration, scale for production will become even more difficult as the pace of technological development continues unabated.

Marie O’Mahony is an industry consultant, author, academic and frequent contributor to Advanced Textiles Source.

TEXTILES.ORG

TEXTILES.ORG