Three industry leaders talk about innovation in the textile industry and how early adopters impact the development of new technologies and products.

IoClothes describes itself as “A Community Fusing Tech & TextilesTM” that exists to support those who innovate by providing information and helping them to establish the right connections to move forward. Managing director Ben Cooper says, “About 30-40 percent of the [textile] industry has a warm-to-hot interest in innovation—new processes, new materials to differentiate, new ways to offer value propositions to their customers. They span a very wide range—manufacturers, brands, materials suppliers—the full eco system.” Another 20 percent he describes as “moderately interested.”

Early adopters

One might interpret that as a good number of interested businesses, but in B2B relationships, “There aren’t very many true early adopters,” Cooper says. Using a broad interpretation, however, “Early adopters are those that are thinking differently, see some indications of the market changing, but have the means to invest in it,” he says. Among the early adopters, the majority is cautious. “There’s a tendency to hesitate from taking that next step, to seriously build it into a product plan.”

From the perspective of the end-use consumer, “Early adopters are those individuals, especially in apparel, who see that the new technology is a solution for something else,” says Stephanie Rodgers, director of advanced product developments, Apex Mills Corp. “The newer technologies are very niche; you’re making something unique for a very specific market.”

But the real early adopters, she believes, are the research teams and collaborators. “This is where the growth is happening. They have a personal interest, a newness to textiles—the hybridization to combine and create has opened the minds of many in the research world,” she says. “Every major university now has something—textile design, just a knitting machine, something. … They consider themselves textile people, but really they’re chemical engineers or material engineers. There are some hazards to that, but that’s what the seasoned experts are here for.”

“Early adopters [as end users] play a critical role, [but they’re] under-utilized and not used as effectively as they might be,” says Qaizar Hassonjee, president of Hass Tech Associates LLC, Chadds Ford, Pa. One way to use early adopters better is in enlisting their responses to launching new “user experiences.” If early adopters do the beta testing on a product, it can help save both time and money.

“The early adopters are the ones who will say, ‘I like it, or I want it different,” he says. “They become a part of your beta testing, because you can learn from it very quickly. No matter how much you do in-house, once you bring the product out, you have new learning, and that new learning is critical in how it will perform in a 1.1 generation, if not a 2.0 generation.”

In fact, he says this beta testing is more significant than in-house testing. “It’s the instant feedback. Then you can make the experience even better much faster, and as it gets more commercialized, the consumer has a better experience.”

With smart textiles, it’s more complicated because it’s not just about the physical product; it’s also a system with electronics and an app. That “full experience” has to be positive for the user, but getting a product of this kind to market can be time consuming and expensive, he says. That’s a particular challenge for smaller companies.

Small vs. large

Hassonjee has considerable personal experience with both small startups, such as Textronics Inc., and with large companies, such as adidas. He thinks larger companies should operate like a smaller company, but he recognizes that there are problems with that. “A small company can move fast and take risks, but a multi-billion-dollar company … they’re higher profile, have a larger investment, and have more at stake.

Small companies have “a much faster decision-making process,” he says “Large companies can’t do that.” For example, what his team accomplished with Textronics in a few months, could have taken a couple of years with a large company.

Regardless of the end product, or the size of the company, it’s always about the new experience— whoever the end user is. “If that’s the consumer, then you must work that way, even though you go through a business-to-business experience, such as a brand. Even if I’m not selling to the consumer, I have to think about my customer selling to the consumer,” Hassonjee says.

Smaller companies can also benefit from another aspect of today’s marketplace: the relative ease of reaching the consumer directly. “If your end product is designed for the consumer to be the end user, it’s especially useful to go directly to the consumer,” he says. “Then the brands take notice, and you open up those channels.” In his case, adidas acquired his company, Textronics.

But a brand has its own challenges. A brand has to think about how a product fits into its product line. “We were working with a major brand with the sports bra [a smart fabrics product], but they had so many different product lines, so they postponed it for a whole season. That was not acceptable to us,” he says. “That’s when we went on our own and went directly to the consumer. Then a different brand picked us up. Otherwise, who knows how long we would have waited?”

Growing textile technologies

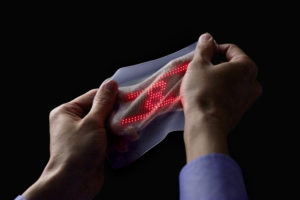

Certain technologies appear to be poised for significant growth. Rodgers puts E-textiles close to the top of that list. Adopters in fashion are most obvious, and some textiles with sensing or thermal control will have an impact. But where the tech is really going to go, she says, is the combination of fiber-optic yarn systems with textiles.

“Fiber optics are fairly rigid now, but advanced research work is crashing the fiber optic world with the yarn world right now and trying to create flexible communication in yarn.” She notes work underway with Advanced Functional Fabrics of America (AFFOA) at MIT, specifically. [See “Researchers weave fabric that incorporates optoelectronic diodes in its fibers” on this site.)

But the biggest growth spurt in textiles will be in composites, Rodgers believes. “There’s a good market now, but I think the polymer chemistry has changed and more traditional textiles will be placed into resin systems and allow that resin system to perform better than it would without it,” she says. “In the early stage in composites, the resin did most of the work, but more functional systems—resin and textile systems together—can be thinner and be shaped into more form factors. Textiles allow this.” The automotive and aviation industries, in particular, will benefit from this development.

Cooper cited manufacturing process developments as one of the exciting things happening in the textile industry today. “Companies are making really significant changes, which will make more advanced textiles possible: 3D modeling, 3D scanning of materials, transferring into new cutting processes, optimizing processes and getting ahead of system malfunctions—these are incredibly important because you have to become more efficient,” he says.

“It’s my belief that smart textiles will bust open this industry in a way that very few can even imagine. … The Internet of Things is real,” he says, creating the possibility of whole new economies, with textiles adding “incredible value” to everyone’s lives. “It’s inconceivable that it won’t happen. … The problem is that we rely on six smart people who sit in a room to come up with ideas for millions of people. That’s absolutely backward. When you have people build on each other’s work, we create economies on top of these products. That’s how you create value.”

It will, however, require a radical new way of thinking about how the textile industry would generate revenue. Cooper points to Kodak’s demise as a lesson to be learned. “Kodak had the patent for digital cameras. They used film. That’s how they made their money. They couldn’t see how they could generate revenue beyond that single point of sale.”

Meanwhile, Instagram became a $100 billion industry giant in just five years. “What could textiles do?” he asks. “We’re exploring new territory, but we already have textiles and textile products—and there was no digital photography.”

There are many more functionalities and market areas that Rodgers expects to be impacted by new textile technologies. “Photovoltaics, safety, infrastructure—there are going to be places where we’re covering fabric that we haven’t been,” she says. Cinder block could contain textiles, and high performance, communicating yarn could signal the lights to turn on or off.

Imagine if Puerto Rico, for example, had had tarps that combined photovoltaics to not only cover a roof temporarily, but to provide power that could be used house-to-house, at least temporarily. The U.S. Army, she notes, already has similar applications, and some of their technology, including photovoltaics, “is out on the street.”

Hassonjee is looking at new markets for smart textiles, such as in senior living. Because seniors are very comfortable with textiles and they’re familiar in so many ways, he says it makes sense to be looking at this market for products that support “aging in place.”

“Moving has a psychological impact, and a financial impact that’s huge. To extend independent living for a year or even six months, it’s significant, and the quality of life is better,” he says. It’s also a market with a future. “Every day there are 10,000 new seniors, and that will continue for the next 25 years.”

One of the tech developments that will literally power innovation in smart textile development is 5G, which Cooper says will reduce power consumption down to a fraction of what is used now. “Power issues won’t really be there, the requirements for hardware will not really be there. Investment in these things will not be required. Where we get our revenue is from services we build on top of it. All the more reason that textiles become platforms.

Challenges

Because new technologies tend to be so niche, the number of users are “drilled down” with each innovation, Rodgers says, which makes producing a successful application more difficult. She cites Ralph Lauren as a good example, “because I think they’re really trying to expand in this market.” The company most recently made the heated jackets worn by the U.S. team at the 2018 Winter Olympics, which it will launch into the consumer market this season. But, “It’s a real challenge to build ubiquity,” she says.

It’s difficult, Rodgers says, for some businesses to wait for something to catch on, and to be timely in the introduction of a new product. Antimicrobials in textiles have struggled with a variety of market impacts, including customer acceptance, which she thinks has made that market confusing.

An important means to the ultimate success of a new product is using focus groups. “Getting a new product in front of a focus group and getting their feedback is important. It allows you to prioritize, get the feedback that you need to move forward,” she says. “You iterate fast if you have a prototype center that does that.”

“What I don’t want to happen in e-textiles is that they just blow themselves out,” she says. But marketing for them is “very complex,” and standards for e-textiles, which she is involved in developing, are important. “Everybody just can’t do their own thing,” she says.

In textiles, there are so many steps, Rodgers says. “It’s an exhaustively painful process.” Having textile developing centers, such as AFFOA, where people can go and get help, she thinks is a great idea, and will help to “soften some of the IP frustration” generated by confidentiality concerns. “But you have to pick and choose where you’re going to go, because you don’t want IP to leak.”

For small companies, it’s often the need for investors, and connecting the two, is “not very efficient,” Hassonjee says. “What’s needed is a faster time frame, at a lower cost.” Early adopters can help, though, because you can demonstrate success with them. And improve your chances. You take the risks, but you get rewarded, if it works. After all that in-house testing, there is still that unknown. That’s where the early adopters come in. My philosophy is to do that earlier and faster.”

Cooper also sees the need for more access to capital. A normal R&D budget in a textiles product company doesn’t compare to that of a tech company, he says. “We’re in an extremely commoditized market, generally,” he says. “But if we rethink our business model and how we offer value to our customers, we realize that we have the opportunity to create platforms. That’s an important distinction. When an article of clothing becomes a platform, it’s a whole new game.”

And he’s starting to see the shift. A shirt can give the wearer his or her heart rate, but an open system allows people to create something more with this. “Like the Apple app store,” he says. “Who doesn’t rely on the app store to customize their phone? Everybody does that. Imagine if your jacket or your shirt did that.

“I see smart textiles as a general sort of technology. Automotive, home textiles … I don’t look at that as different from medical or fitness. I see it as continuous. … When somebody says, ‘we’re going to play the long game on this; it is an incredible opportunity,’ we’ll create systems that people will not say “no” to. This is what creates a new business that cannot fail.”

Innovative change also requires people who think differently—radically differently. “There’s a lot of incremental innovation,” Cooper says. “Greater resistance, better durability, and so forth, which is good and it’s important. But what we need is not ‘why you can’t do that,’ but ‘let’s try that.’ A lot of people play not to lose, and others play to win. We need people who will play to win on a grand scale.”

Janet Preus is senior editor of Advanced Textiles Source. She can be reached at jlpreus@ifai.com.

TEXTILES.ORG

TEXTILES.ORG