Advanced technical products

Growth in the U.S. advanced technical products market (ATP) is 6 percent annually; the economic slowdown in the first quarter of 2014 didn’t dampen growth in this resilient market. Growth was buttressed by the improving job market in 2014; growth is expected to be flat in the military area of this market segment but should improve in manufacturing segments such as automotive. Supporting growth in 2015 is an expected decline in unemployment to 5.5 percent; it fell to 5.6 percent in December 2014, the lowest since June of 2008.

Outlook. In the October 2014 IFAI survey, suppliers and fabricators reported they expect sales will increase 6 percent in 2015 compared to 2014 due to the improved economy enhancing a much improved employment environment. Military clothing, construction and industrial markets—especially the automobile/industrial market—will continue to drive growth. Trends noted include growth in the arc flash and flame-resistant segments.

At IFAI Expo 2014, medical equipment was cited as a market opportunity for growth in 2015. International competition, especially China, was noted as a potential threat to growth, but this was also seen as an impetus for ensuring domestic suppliers continue investing in the necessary resources—people, money and equipment—to improve their business. In fact, some U.S. participants see more opportunity for themselves in international markets, which helps to counter the foreign competition effect.

Military markets

The military segment covers safety and protective products (including the use of smart technology) for troops, firefighters and law enforcement. A driving force behind product development for the firefighter, law enforcement and industrial markets, the military’s influence on the safety and protective market will continue well into 2015. Spending on military textiles and clothing decreased 6 percent in 2014, and although spending on military textiles and clothing is expected to be flat in 2015, the level of spending is expected to come in at a substantial amount—around $1.6 billion.

Although the U.S. ended its combat operation in Afghanistan in late October 2014, a smaller force will remain. The U.S. government is also funding new programs to combat the Islamic State (ISIS). Defense budget cuts are expected to result in marginal growth for the global military infrastructure (including clothing and textiles) market.

The U.S. military market is supported by the Berry Amendment, a “Buy American” program designed to ensure a secure source of clothing and textiles for the U.S. military. When President Obama signed the American Recovery and Reinvestment Act in February 2009, the Department of Homeland Security’s Transportation Security Administration (TSA) and the U.S. Coast Guard also became Buy American programs.

Although the U.S. military clothing and textiles market is expected to realize flat growth in 2015, due in large part to the withdrawal of the majority of its troops in Iraq and Afghanistan, the U.S. will continue to be the largest spender on military products in the next decade. Spending will be driven by new initiatives from the U.S. Army to strengthen and regroup its military base in Europe.

Canada is also expected to provide sufficient funding for infrastructure/logistics (including clothing and textiles) according to the Canada First Defense Strategy, which was formulated in 2008. Due to these factors, the U.S. and Canada are expected to remain as the leading military spenders, representing 38 percent of the global market. Asia and Europe are also expected to account for a significant portion of the total military infrastructure (including clothing and textiles) with about 27 percent of the global market. This will be driven mostly by the efforts of countries such as India, China and Russia to revamp their armed forces.

There are several significant market segments within the narrow fabrics market, ranging from seat belts for the automotive industry to leashes for pets. At IFAI, we focus on five key segments: webbings for automotive seat belts; military textiles and clothing; safety products, such as harnesses; transportation products, such as tie-downs and slings; and medical products, such as gauze and bandages for wound care.

The overall U.S. narrow fabrics market grew an estimated 2.4 percent in 2014; the rigid market (seat belts, slings, tie-downs, cargo nets) grew 5 percent in 2014; and the elastic market (medical, industrial, recreational, but not apparel) grew 4 percent. Over the next few years the strongest growth will come from Asia (China) at 5.5 percent and in South America at 5.2 percent, while the U.S. will continue to grow at 2–2.5 percent annually.

The main growth area over the last few years has been webbings for seat belts. The sales of new light vehicles in the U.S. grew some 6 percent in 2014—reaching 16.4 million vehicles, which translates into 246 million meters of seat belt fabric sold. Spending on military textiles and clothing in the U.S. decreased 6 percent in 2014 compared to 2013 and is expected to be flat at $1.6 billion in 2015. Sales growth for military narrow fabric products was flat in 2014, but may be up slightly in 2015.

The market for safety products (harnesses, in particular) grew 4 percent in 2014 as markets like construction continued strong growth in 2014. This was supported by government actions; the U.S. government committed $100 billion to federal highway and transit programs in 2014–2015, and the Canadians committed $70 billion over the next 10 years for infrastructure and buildings. Construction is expected to grow 5–6 percent per year over the next few years in the U.S. and Canada.

Tie-downs and sling sales in the transportation market are growing, but U.S. tie-down manufacturers continue to feel the effect of lost sales due to inexpensive imports from China and Korea. This market is growing 2.5–3 percent per year, as web tie-downs continue to replace wire rope and chains. There is also more use of strapping materials (polypropylene, polyester, nylon, or corded/woven) in the packaging industry, as they have become more cost effective, although polyester has replaced much of the higher-priced nylon.

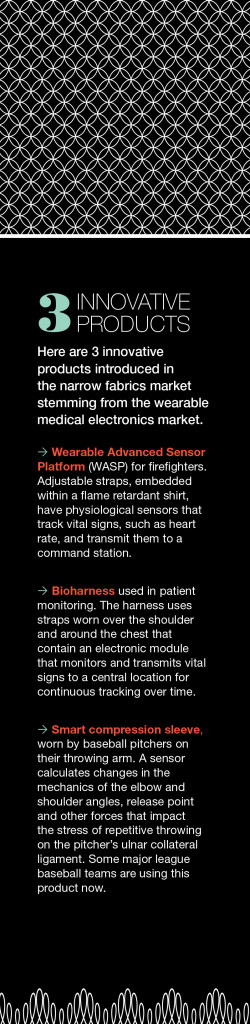

The medical products market grew 5 percent in 2014 and is expected to grow 6 percent in 2015. The U.S. market looms large with its 80 million baby boomers remaining active and requiring medical help in the form of wound care—gauze and bandages, orthopedic braces and castings, for example. The 83 million millennials (people born in the 1980s and 1990s) in the U.S. are embracing innovative smart fabrics, such as wound dressings that change color to indicate an infection.

The smart fabrics market is expected to contribute consistent, above-average growth to the narrow fabrics market—especially as millennials embrace innovative technologies for years to come.

Small to mid-sized companies are common in the narrow fabrics market. Over the past five years or so, they have invested in growth markets such as medical and safety. Inexpensive imports from Asian countries remain a serious competitive threat, especially in the sling market. On a positive note, 2014 saw U.S. companies returning production facilities from overseas to the U.S. and Canada.

Going forward

Industry participants who actively look for opportunities to exploit in the marketplace and take advantage of them are cementing their place as leaders in the industry. Their position is that they must continue to invest in innovative products and internal business processes each year or run the risk of losing their standing in the marketplace. They are well aware that competitors from across the globe are working vigorously to penetrate and grow their place within their respective markets.

These industry leaders continue to selectively invest in new product development, internal business processes such as supply chain logistics, Enterprise Resource Planning (ERP), and Six Sigma lean manufacturing programs. Such investments have enabled U.S. manufacturers to become more competitive with foreign imports, including China and India, as the costs of production and labor continue to escalate in China, resulting in greater parity with U.S. manufacturers.

TEXTILES.ORG

TEXTILES.ORG